While running payroll, if you are unable to create a paycheck an employee due to a KYC check, you can use the Manual Payment option until the verification goes through. Also be sure to upload their KYC documents.

Uploading Identification Documentation

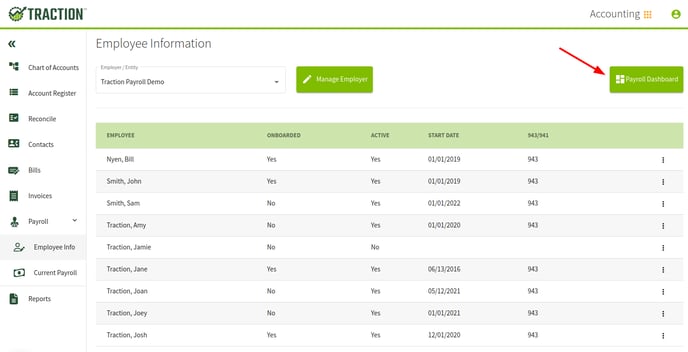

1. Navigate to the Payroll->Employee Info and click on the Payroll Dashboard button. This will open a new tab inside the Payroll Dashboard.

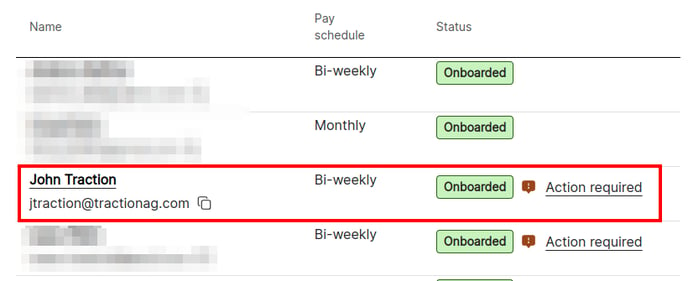

2. Click on People and find the Employee that has been flagged for KYC. You can find them with an Action required status.

Click on their Name to open the Employee's profile page.

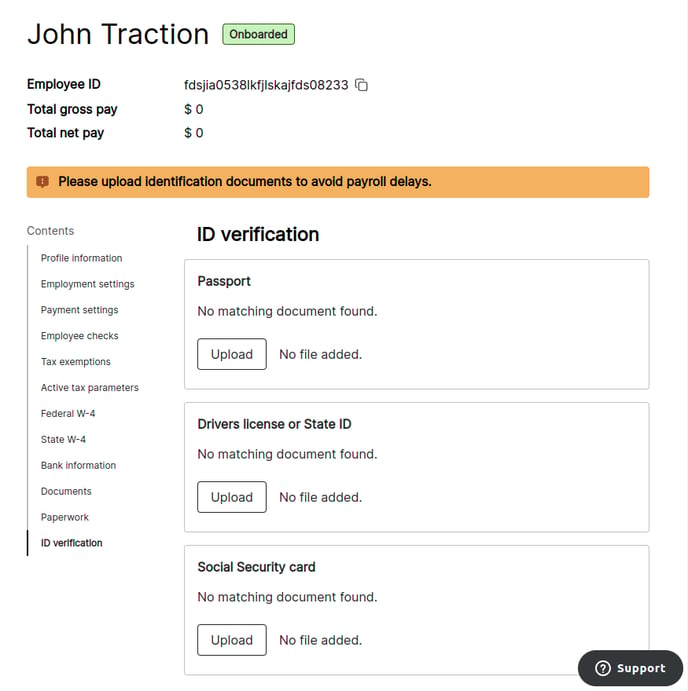

3. Click on ID verification from the side menu (at the bottom). You will need to upload, in a single file, the front and back of both the Drivers license or State ID, along with the Social Security card.

After submission, it may take 24-72 hours before the Employee is verified.

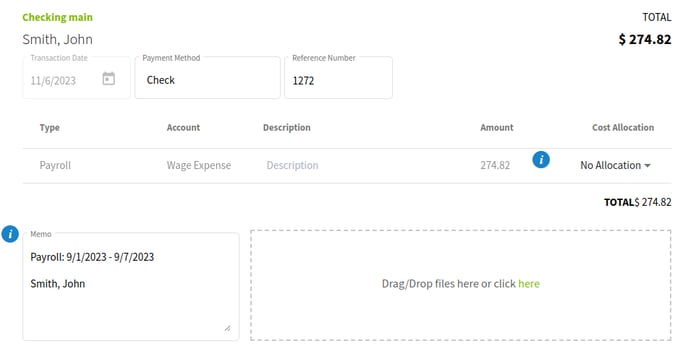

Enter a Paycheck Now

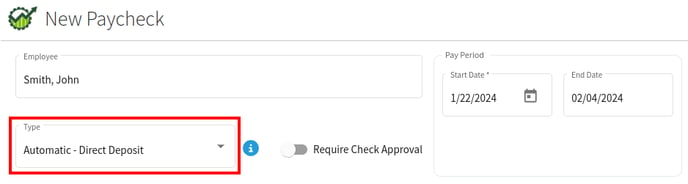

1. From the New Paycheck screen, check to see if your current Type is Automatic - Direct Deposit.

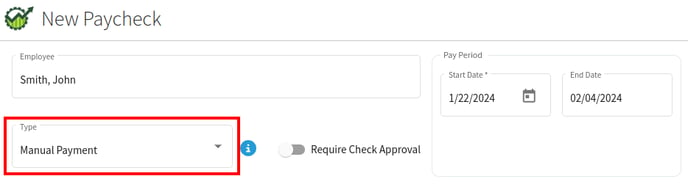

2. Update the Type to Manual Payment and you should be able save the paycheck as usual.

3. Once the paycheck is processed (the evening 48-hours before the pay date), you can either print it from your Account Register or hand write the check for the net amount listed.