How do I record Livestock in the Chart of Accounts in Traction?

The tax laws for purchased livestock (Cash Basis) require that growers treat the purchase cost of livestock as an asset (inventory) when they buy the livestock. And then to expense the cost of the livestock when sold.

While Traction can be used to capture certain livestock-related information, the platform is not currently designed to fully support livestock operations.

Let's walk through a scenario where you are recording the purchase of $1000 worth of cattle as an asset. We will then record the expense when you sell the livestock.

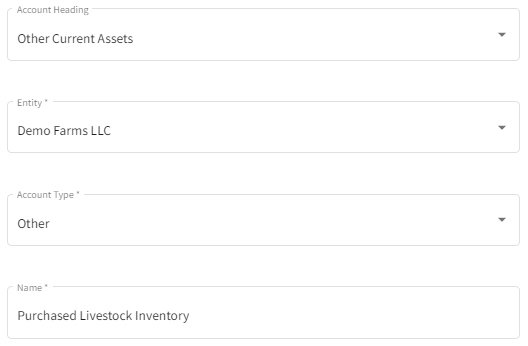

Add your asset account for the livestock

- In the Chart of Accounts, add an "Other Current Asset" for the livestock inventory account.

- In the account type, select "Other".

- In this scenario, we are going to use the name "Purchased Livestock Inventory".

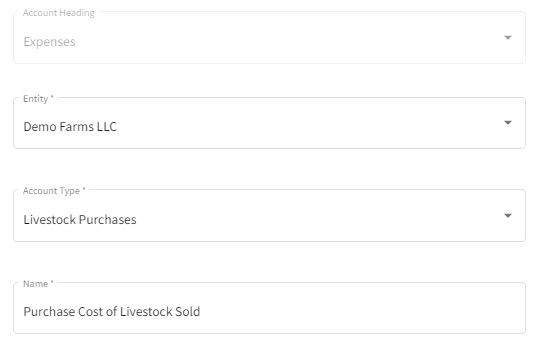

Add the expense account for the purchase of the livestock

- In the Chart of Accounts, add a new "Expenses" account.

- In the account type, select "Livestock Purchases".

- In this scenario, we are going to name the account "Purchase Cost of Livestock Sold".

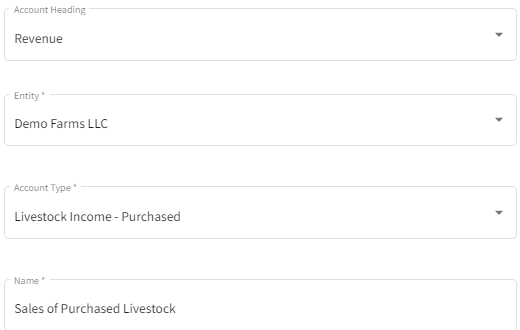

Add a revenue account for the sale of the livestock

- In the Chart of Accounts, add a Revenue for the sales.

- In the account type, select "Livestock Income - Purchased"

- In this scenario, we are going to name the account "Sales of Purchased Livestock".

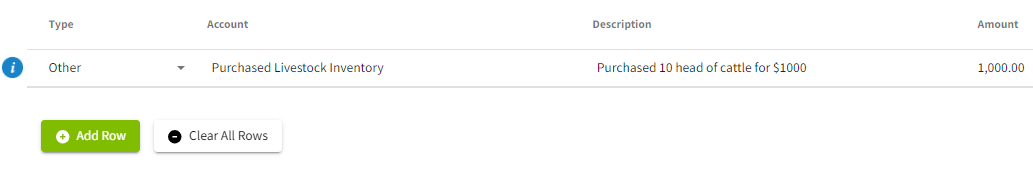

Purchasing livestock

- When purchasing the livestock, we are going to select the "Purchased Livestock Inventory" other assets account.

- Now we are going to add the remaining details (Description and Amount) of the purchase to the transaction.

- Review your work and save.

And that's it. The purchase of the livestock has been recorded in your account.

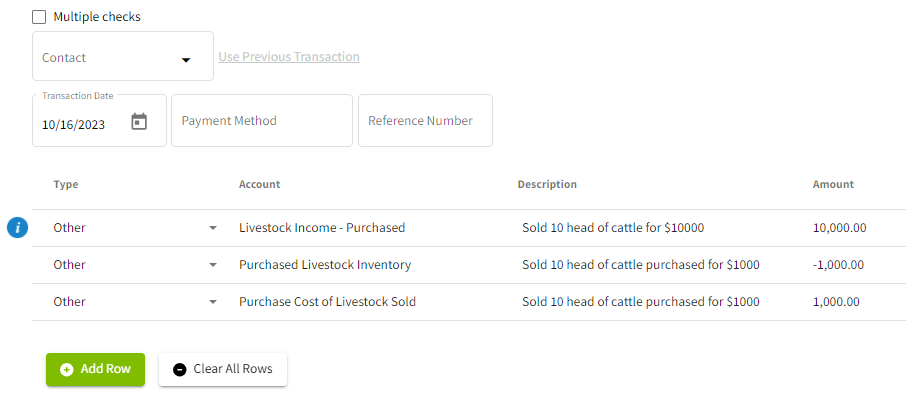

Selling livestock

- Create a new deposit transaction and select the "Sales of Purchased Livestock" account.

- Enter the quantity and unit cost in the description.

- Enter the total amount received in the amount.

- Next, we are going to add another row and use the "Purchased Livestock Inventory" account.

- Enter the cost of the cost of the livestock sold as a NEGATIVE. This will remove the cost of the livestock from the other asset account.

- Lastly, add another row and use the "Expense of Livestock Sold".

- Enter the cost of the livestock sold as a POSITIVE. This will add the expense from the purchase of the livestock to the expense account.

- Review your work and save.

And that's it. You have now recorded the sale of your livestock.