How do you add Land Improvements Accounts to Traction?

This article demonstrates how to add Land Improvements accounts to Traction.

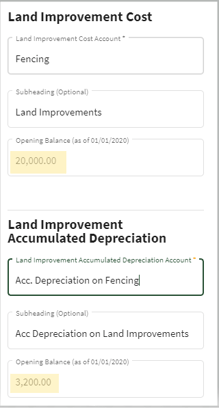

Your depreciation values usually come from your accountant as part of your annual financial report. These values should be entered into your system as opening balances when you set up your accounts.

If your accountant provides updated depreciation figures or you need to make changes later on, you can handle those by creating a journal entry, please visit this knowledge base article to learn more.

Depending on your accountant, this report might be called one of the following:

- Depreciation Schedule

- Tax Depreciation Schedule

- Depreciation and Amortization Report

- Fixed Asset Depreciation Schedule

- Depreciation List Report

| 1. Using the navigation menu on the left, open the Accounting menu and then select Chart of Accounts. |

|

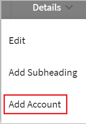

| 2. Scroll down until you find the Property & Equipment folder and click on the arrow to the right of Details. Select Add Account. |

|

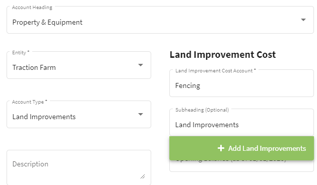

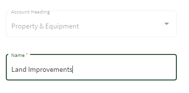

| 3. Fill in the boxes with the land improvement's details and create a subheading under Land Improvements Cost, for example: Land Improvements. Click on the green box with the + Add Land Improvements to add the subheading. This will take you to the Add Subheading screen where you will confirm the Name and then click on Save & Close. |

|

| 4. When you return to the Edit Account screen fill in the account information and add the subheading for the Land Improvements Accumulated Depreciation section. Click on the green box with + Add Acc Depreciation on Land Improvements to add this subheading. This will take you to the Add Subheading screen where you will confirm the Name and then click on Save & Close. When you return to the Edit Account screen enter the Opening balances and click Save & Close. |

|

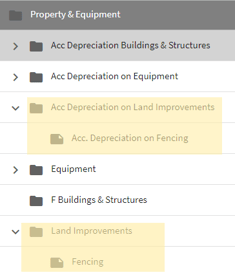

| 5. The subheadings and accounts were added to the Chart of Accounts under the Property & Equipment heading. |  |