How do I return a product that I purchased in my Bills?

In this article, we'll walk through how to add a negative amount to your transaction to adjust the final total of a bill.

Your example may be different. Please note which account you are returning the product against and update the directions accordingly.

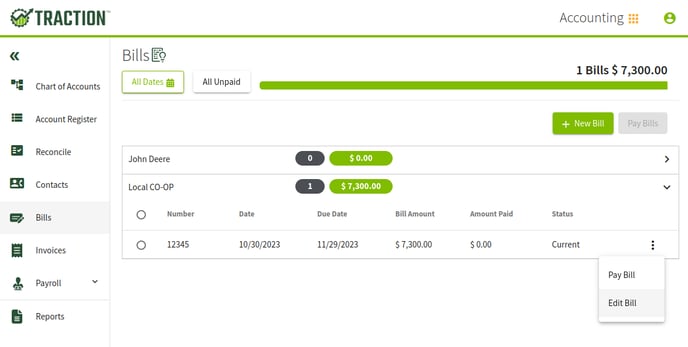

Navigate to your bill inside the Bills area of Accounting.

Scenario A: No Activity on the Bill

If your bill has not had any payments made against it, you can simply update the Bill with the current information by clicking the three dot menu and selecting, Edit Bill.

Scenario B: Previous Activity on the Bill

If your Bill has already had a payment applied, you will need to update your payment transaction.

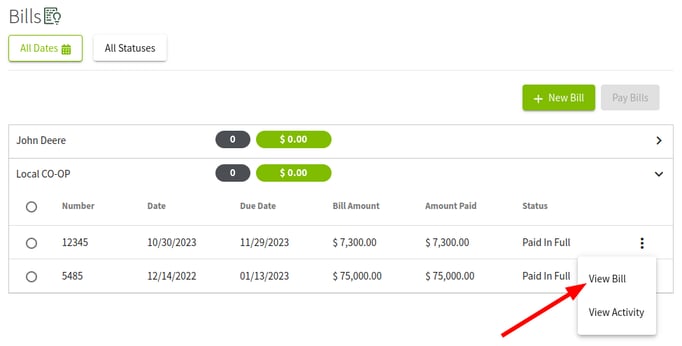

First, click on the three dot menu and select View Bill.

This will allow you to note the unit cost. You will need this for your return transaction.

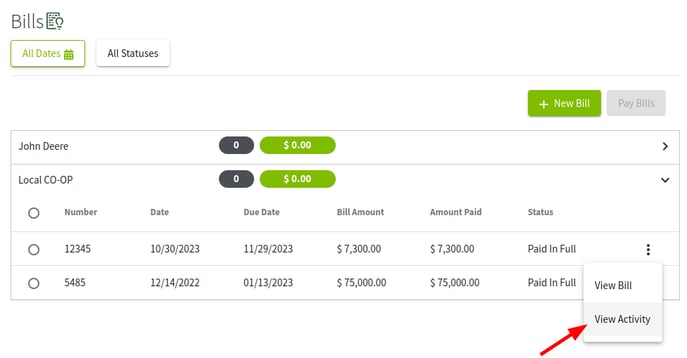

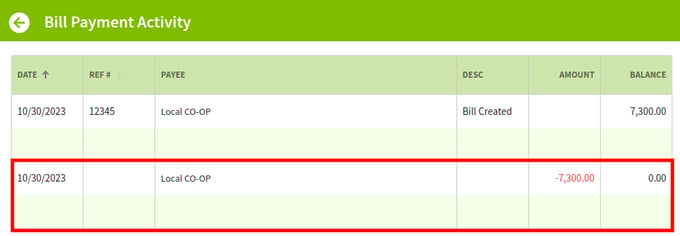

Next, you can find your previous transactions by clicking on the three dot menu and selecting, View Activity.

Here, you can click on one of the previous payments listed to bring up the corresponding transaction.

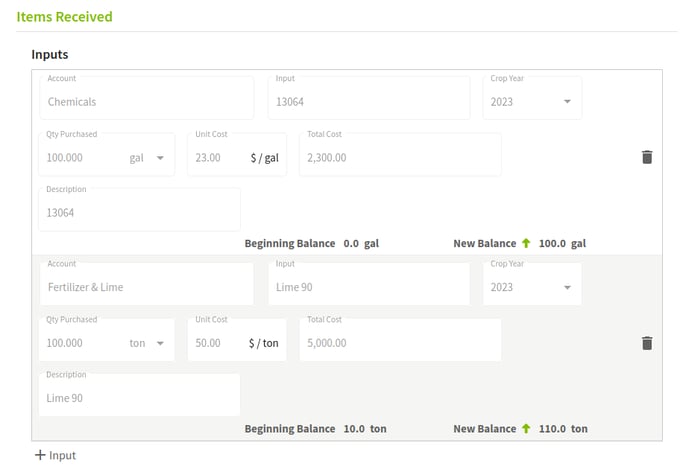

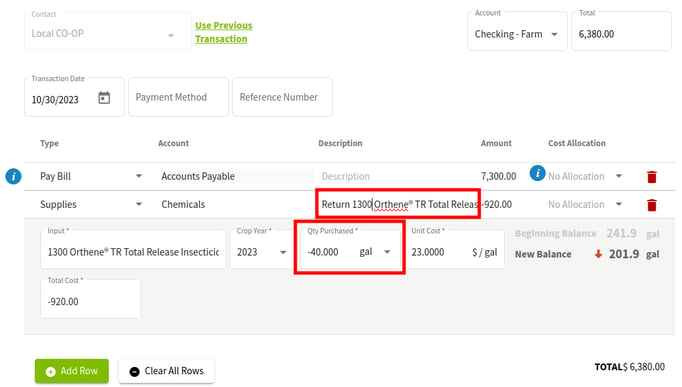

In the transaction, add a new row for each supply you are returning and be sure to select the Supplies type.

If you are returning something that isn't related to an inventoried Input you are managing in Traction, you can leave the type option on Other.

In our example, we will be returning 40 gallons of 1300 Orthene® TR Total Release Insecticide at a cost of $23.00 per gallon.

You will enter the quantity as a negative amount and add the word Return to the description so you can easily reference this entry in your Chart of Accounts.

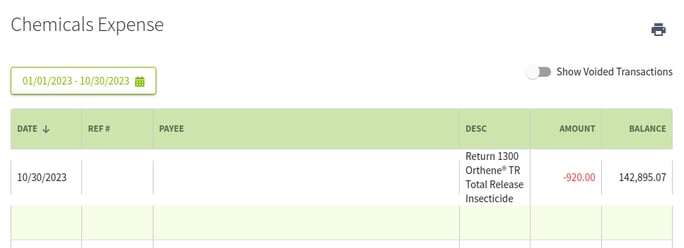

Now your accounting and inventories are up to date. You can review the transaction in your Chart of Accounts by viewing the appropriate expense account.

In our case, the return is for our Chemical Expense account.

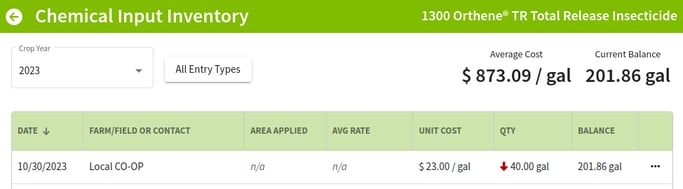

You can also see the inventory change under your Input inventory view in Field Operations.

And that's it. While you cannot edit the total on a Bill that has already had activity, you can update your books to reflect any refunds or exchanges.

Scenario C:

Applying a Partial or Full Credit for Returned Items

If you’ve returned items from a previously paid bill, Traction allows you to record a credit for the returned amount. You can then use that credit—whether partial or full—to pay current bills.

This guide walks you through:

-

Recording a credit for returned items.

- Applying a partial credit and adjusting payments so the totals balance.

- Applying a full credit to a new bill.

Following these steps ensures your account reflects accurate balances and payments while keeping your billing records up to date.

If you’ve already paid a bill that included an item you later return, and you receive a credit from the vendor, you’ll need to record that credit in your bills and apply it to current or future bills.

Example Scenario

You are returning 5 gallons of 2,4-D Amine at $40 per gallon, for a total credit of $200.00 to Advanced Ag Systems.

You’ll use this $200 credit to pay an outstanding bill with Advanced Ag Systems.

Step 1: Enter the Credit to your Bills

Select Bills from the left hand menu bar, next select+ New Bill

Step 2. Enter the details of the returned item, making sure to use a negative quantity for Inputs or a negative dollar amount for items classified as Other. Once all return details are entered, click Apply.

Step 3. Select Save and Close after reviewing the credit entry.

If applying the full amount of a credit to your payment skip to Step 6

Step 4A: Appling a partial credit to a bill

After you save, the credit (for this example, $-200) will appear in your Bills list alongside any current bills (for this example, $150).

Because the credit amount ($-200) is larger than the bill amount ($150), your account will show an overall credit balance of $-50.

To apply the credit to the $150 bill:

-

Select both the $150 bill and the $-200 credit.

-

Click the Pay Bills (2) button.

Step 4B: Adjust the payment to apply the partial credit

When the New Payment window opens, both bills will be automatically filled in. You’ll see a Total showing a negative balance.

Because Traction does not allow negative payments:

-

Change the Total amount to $0.00.

-

Update the credit amount from $-200 to $-150 so the payment and credit balance each other out.

-

Click Save to complete the transaction.

Step 5. Select Yes to save the payment as $0.00

After saving, you’ll see a remaining credit balance of $-50 with Advanced Ag Systems. The $150 bill will show as Paid in Full, while the Credit Memo stays open, reflecting $200 credited with $150 applied.

When paying your next bill, select the Open Credit Memo along with any other bills for this vendor to apply the remaining $-50 credit. This will use the balance and bring the Open Credit to zero.

Skip step 6 if you are making a partial credit payment

Step 6A. Applying the full credit amount to a payment

After you save, the credit (for this example, $-200) will appear in your Bills list alongside any current bills due (for this example, $500).

To apply the credit to the $500 bill:

-

Select both the $500 bill and the $-200 credit.

-

Click the Pay Bills (2) button.

Step 6B: Review and save the payment to apply the full credit

When the New Payment window opens, both bills will be automatically filled in. You’ll see the Total payment (for this example, $300.00).

-

Click Save to complete the transaction.

You have now successfully used your credit to pay your bill.