How do I handle supply inventory returns and apply credit for future purchases?

This article will explain how to enter a supply inventory return and apply the refund as a check/credit to the expense account in Traction.

Note: You must have both Basic Accounting and Basic Operations in order to use this feature. Visit our Plans and Pricing page to learn more. Inventory is recorded in Accounting and the running total is viewed in Operations.

| 1. Select Accounting and go to the Account Register. |  |

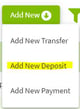

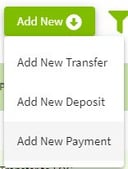

| 2. Click on the Add New + button and select Add New Payment. |  |

|

Returning 20 gallons of 1300 Orthene. 3. Click on the arrow to the right of Other in the type column and select Supplies. Select the Chemical account and fill in the details for the Input. Enter a negative value for quantity purchased. Next, click on the + Add Row button. |

|

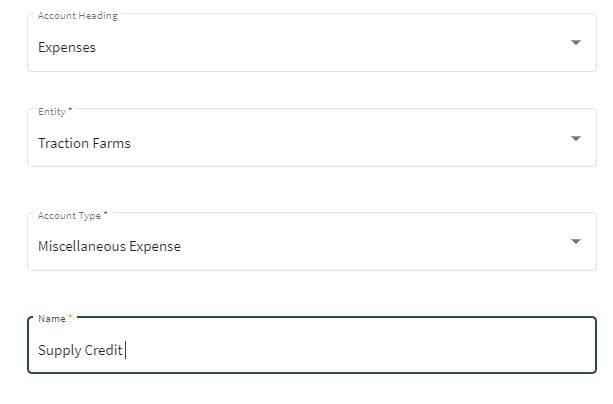

| 4. Click on the Account then click on the green New box. Fill in the information for the new account then click on the Save & Close button. Fill in the positive amount and also add a description. Click on the Yes button to confirm the 0.00 payment amount and to update the field records. |

|

|

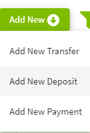

Applying a check refund to Chemical expense. 5. In the Account Register click on the Add New button and select Add New Deposit. Select Chemical Expense for the account and enter all of the transaction details. Click the Save button when finished. This will correct the Chemical Expense account balance. |

|

|

Applying a credit for the returned chemical to a new purchase. 6. In the Account Register click on the Add New button and select Add New Payment. Select Supply Credit for the account and enter the credited amount as a negative. Add any new inputs that are being purchased in this transaction. Next, click the Save & Close button when finished. |

|