How do I enter a Roth 401(K) with an Employer contribution in Traction Payroll?

In this article, we'll walk through the process of adding a Roth 401(K) deduction, that includes an Employer contribution.

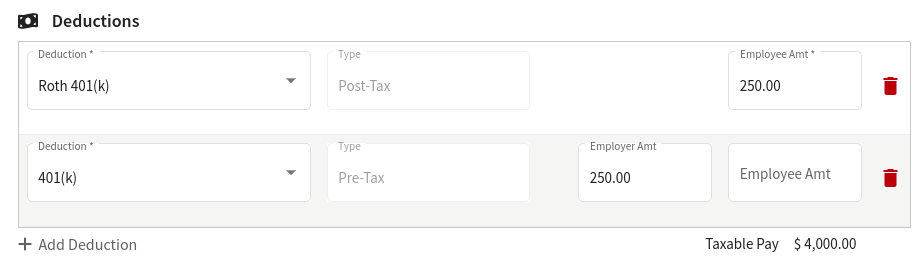

1. In your employee's new paycheck, click the + Add Deduction button. A new row for a deduction will appear. From the drop-down, select, Roth 401(k).

2. To include an Employer contribution, repeat the process above, but add a 401(k) deduction line.

3. Fill out the appropriate amounts for the Employee contribution on the Roth 401(k) line and the Employer contribution on the 401(k) line.

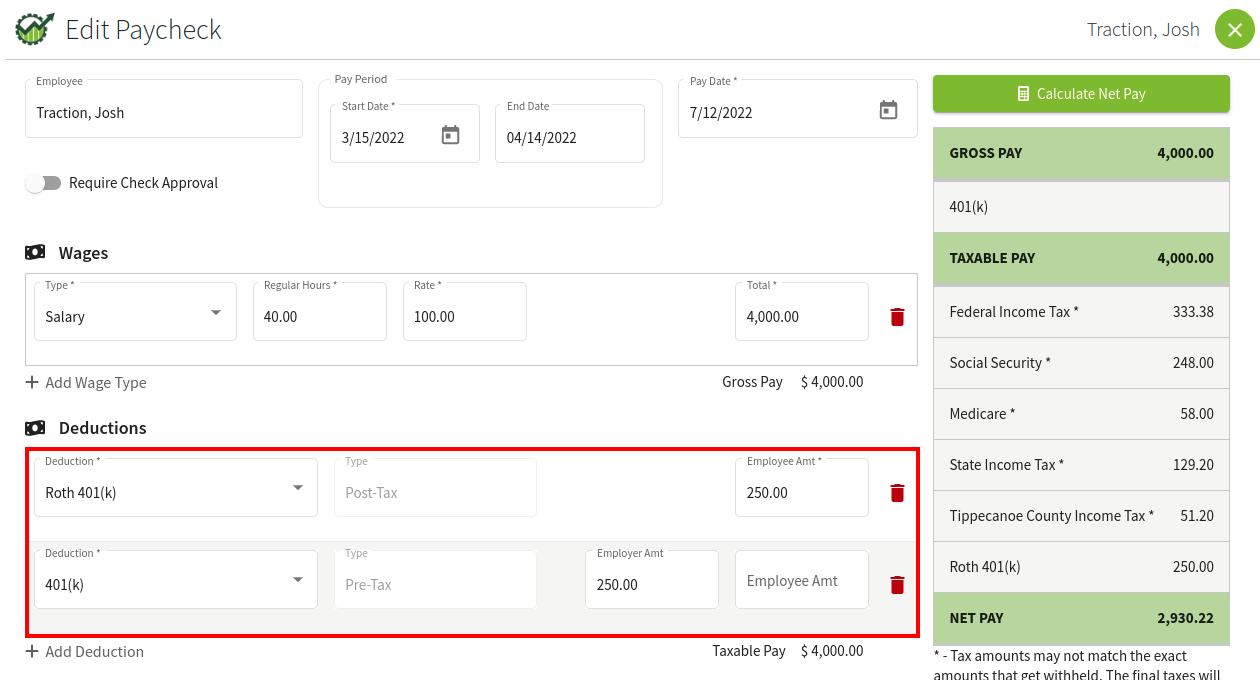

4. When you add both deductions, your paycheck should look similar to this:

5. Click the Calculate Net Pay button to verify the taxes and deductions and you're all set.