How do I create and manage Budgeted Cash Flows?

This article will demonstrate the Budgeted Cash Flow functionality that helps you forecast, track, and analyze farm expenses, revenue, and assets.

A Traction Pro Subscription is required for this feature. Please contact your account manager or call us at 888-466-6080 (option #1) to learn more about upgrading your subscription.

1. How do I create a budgeted cash flow report?

2. How do I use the Fill Cells feature?

3. How do I create and manage my revenue category?

4. How do I create and manage my Expense category?

5. How do I manage Asset Sales?

6. How do I manage Asset Purchases?

8. How do I manage Debt Reduction?

9. How do I manage Owners Draw?

10. How do I manage Cash Position?

11. Scenarios

12. Budgeted vs Actual

How do I create a budgeted cash flow report?

1. Navigate to Reports on the left hand menu, expand and click on Accounting. Click on Budget then click on Budgeted Cash Flow.

2. Click on the drop down box and click the +New button.

3. Fill in the Start Month, Budgeting period, Entity, and a description. In the Copy From box you have the option to choose using Previous Year's Actual Balances in the new budget. This will fill in the Revenue and Expense values with the previous year's actual values for you. When you have completed your options, choose Save.

4. The page will fill in based on the entity & date selections, you will then click edit at the bottom right to access and fill in categories.

- Inactive accounts are hidden in the budget, unless they had a value in the budget before the account was inactivated.

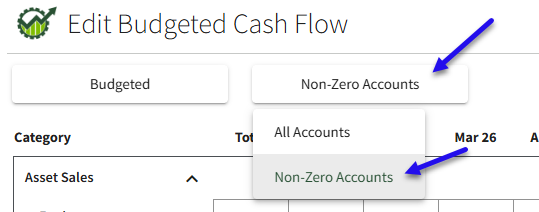

- The budget has the option to show “Non-Zero Accounts”, this will be useful for hiding accounts that are not being budgeted.

- If you turn on Budgeted vs Actual, and have Non-Zero Accounts, accounts that have either budgeted or actual values will be shown.

Cash Position - If you are looking for a better understanding on where these values are populating from, please visit Section # 9, How do I manage Cash Position?

How do I use the Fill Cells feature?

The FillCells feature allows users to quickly populate a current budget using data from a previous budget or actual financial results.

- From the Edit Budgeted Cash Flow screen, You will see the Fill Cells button to the upper left of your screen. Within the Fill Cells screen you will have the option to use Previous Year's Actuals. If you have created a previous budgeted cash flow, you will have that as an option in the drop down as well.

From Previous Year’s Actuals

- Useful if this was not chosen getting started in the New Budgeted Cash Flow screen to populate actuals during budget creation.

-

Fills in Revenue and Expense accounts. *Note - This will replace anything that was entered.

- Does not fill in Investments, Financing, and Owner Draws.

From Previous Budget

- Any Previous Budget for any combination of entities and date range. However, if different entities and accounts are selected which don't exist in the current budget they will be skipped.

- Can be from a different year/date range

- Fills entire budget except for Cash Position this will be based on dates and entities of the new budget.

How do I enter Revenue?

1. Click on the drop down arrow to the right of Revenue.

2. The action above will list all revenue accounts for the selected entities.

3. Enter the expected revenue that you will receive for each account in the month that you expect to receive the cash/ record the deposit. You will enter the amount in the white cells and these will

If you receive the same amount each month, enter the total for the year in the “Total” column and it will get split evenly between the months.

How do I enter Expenses?

1. Click the drop down arrow to the right of Expenses.

2. You will see listed all active expense accounts for the selected entities. Enter the expected expenses that you will pay for each account in the month that you expect to pay for the expense (when you write the check).

For prepays, enter the amount to be paid in the month that you pay the prepay and enter nothing for the months when you use the prepays to buy inputs.

If you pay the same amount each month, enter the total for the year in the “Total” column and it will get split evenly between the months. For prepays, enter the amount to be paid in the month that you pay the prepay and enter nothing for the months when you use the prepays to buy inputs.

How do I manage Asset Sales?

1. Click the drop down arrow to the right of Asset Sales.

This will list all active accounts under the following categories in the Chart of Accounts:

- Property and Equipment

- Equipment Land, Buildings & Structures, and Land Improvements

- It will only list the “Cost” accounts and not Accumulated Depreciation

- Other Current Assets

- Other Long Term Assets

2. Enter the amount of cash you expect to receive related to sales in any account in the month you expect to receive the cash.

How do I manage Asset Purchases?

1. Click the drop down arrow to the right of Asset Purchases.

This will list all active accounts under the following categories in the Chart of Accounts:

- Property and Equipment

- Equipment Land, Buildings & Structures, and Land Improvements

- It will only list the “Cost” accounts and not Accumulated Depreciation

- Other Current Assets

- Other Long Term Assets

2. If you will be buying an asset with cash, enter the cash to be paid. If an asset is purchased with both cash and debt, enter the total cost in the asset purchase and the amount to be borrowed in New Debt. If an asset will be traded, the expected trade value can be shown in the asset sales.

How do I manage New Debt?

1. Click the drop down arrow to the right of New Debt.

This will list all active accounts under the following categories in the Chart of Accounts:

- Notes Payable - Short term

- Any account NOT marked as “Functions as a checking account”

(Please note- These accounts will be included in the Cash Positions section of the Budgeted Cash Flow Report. )

- Any account NOT marked as “Functions as a checking account”

- Notes Payable - Long Term

- Other Current Liabilities

- Other Long Term Liabilities

2. Enter the amount of money received/ borrowed on loans in the month you expect to receive it.

How do I manage Debt Reduction?

1. Click on the drop down arrow on the right of Debt Reduction.

This will list all active accounts under the following categories in the Chart of Accounts:

- Notes Payable - Short term

- Any account NOT marked as “Functions as a checking account”

(Please note- These accounts will be included in the Cash Positions section of the Budgeted Cash Flow Report. )

- Any account NOT marked as “Functions as a checking account”

- Notes Payable - Long Term

- Other Current Liabilities

- Other Long Term Liabilities

2. Enter the amount of money paid on loans in the month you expect to pay it.

How do I manage Owner Draws?

1. Click on the drop down arrow to the right of Owner Draws.

1. This will list all active Drawing and/or Dividend accounts for the entities. Enter the net amount that will be paid to owners ( via family living payments and deposits) for each month.

If there will be more income to the farm (Family Living in a Deposit) enter the net amount as a negative value.

How do I manage Cash Position?

1. Click the drop down arrow to the right of Cash Position.

Traction will calculate the Beginning Cash Position for the first month of the budget by taking the balance of the following accounts as of the end of the previous month (Budget that runs from January - December would use balances as of 12/31 of the prior month):

- Total of all Bank and Cash Accounts

- MINUS total of all Credit Card Accounts

- MINUS total of all “Notes Payable Short Term” that are marked as “Functions as a Checking Account”

The Beginning Cash Position can be adjusted if you believe the balance is different than what is being calculated. To reset the balance to the calculated value, simply delete the balance and click away.

The Ending Cash Position for each month represents the budgeted amount of cash at the end of each month. This will be negative in months where the user is borrowing on a Short Term Notes Payable (that functions as a checking account).

Scenario-

Example of a piece of equipment purchased with a down payment, a loan, and a trade in:

Details:- Equipment Purchase Cost $100,000

- Less Trade in of $10,000

- Less new loan of $50,000

- Down Payment $40,000

-

- Asset Purchase $100,000

- Asset Sale $10,000

- New Debt $50,000

- The advantage to this method is you have all details on the asset purchase, if known.

- If the New Debt is an actual new loan, you should also add the payments to the Debt Reduction area.

Budgeted vs. Actual

Budgeted/Budget vs Actual- You can toggle between just showing Budget or Showing Budget and Actual values in the report and the Edit Screen.

- When Budget vs Actual is selected every Revenue, Expense and Drawing/Dividend account will have two lines.

-

- The first line is the budgeted line.

- The second line, which will be in blue in the edit window and in bold in the budget and on the pdf report, will be the actual line.

-

- If you have Budget vs Actual selected and export the report, the csv will have two columns for each Revenue, Expense and Drawing/Dividend account.

- The first column will be budgeted.

- Second column will be actual.

- If you have Budget vs Actual selected and export the report, the csv will have two columns for each Revenue, Expense and Drawing/Dividend account.

-

This report can be exported to a .CSV file or printed as a PDF file.