How do I create a Schedule F Report?

In this article, we'll walk you through the process of creating a Schedule F Report inside Traction.

Traction utilizes the "Account Type" from the Chart of Accounts to decide if Revenue and Expense Accounts should appear on the Schedule F. It also uses the Account Type to determine the correct line on the Schedule F for each account. To clarify the account mapping and identify which accounts won’t be displayed, we’ve created this guide spreadsheet reference.

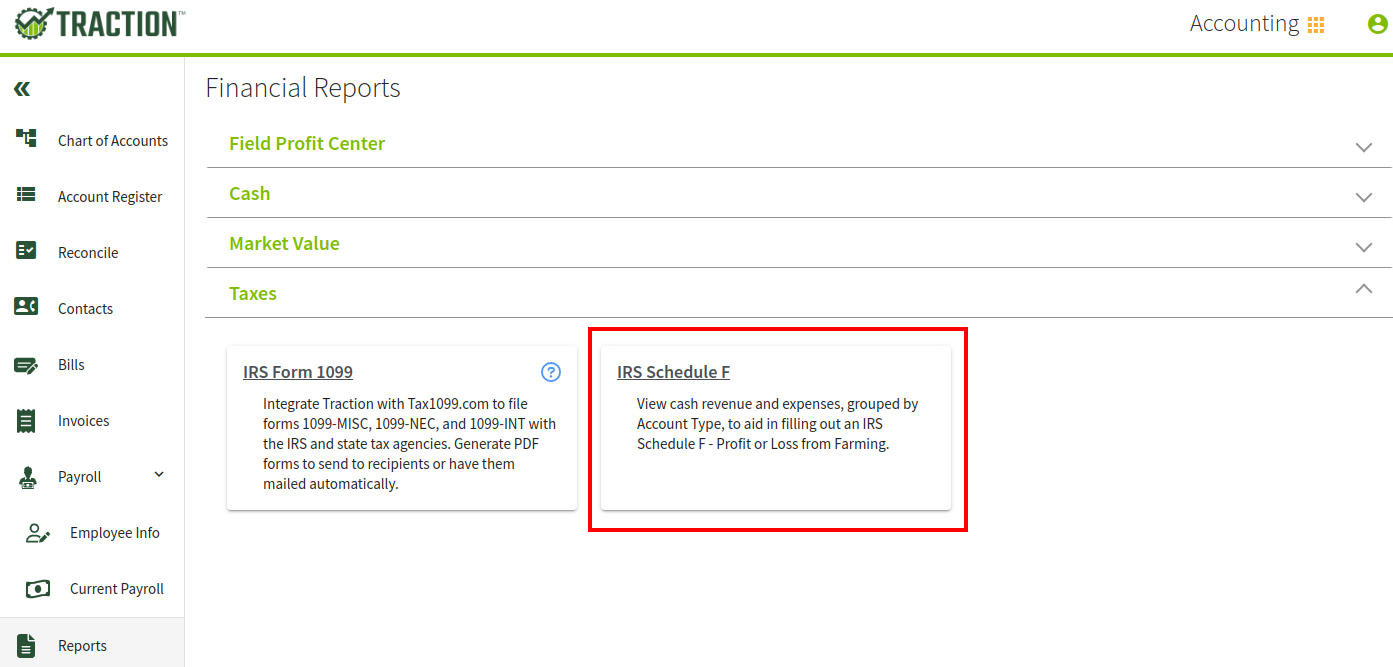

1. Navigate to Reports and expand the Tax section. Click on IRS Schedule F.

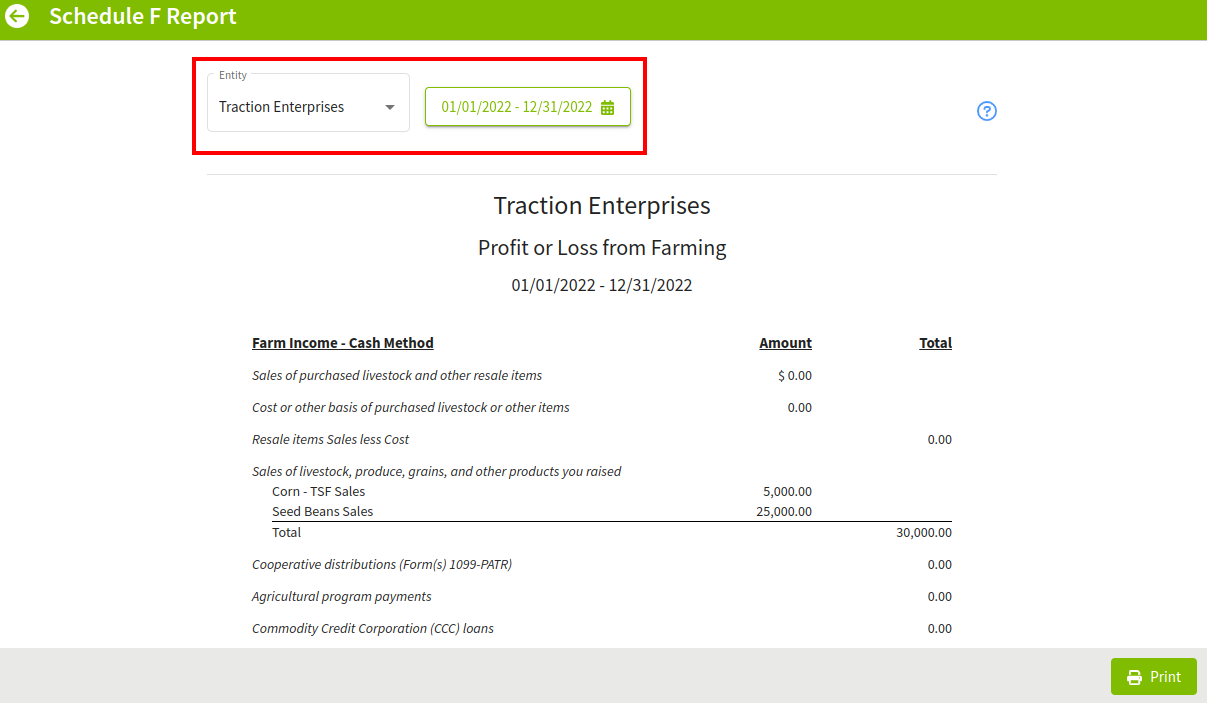

2. A Schedule F Report will be generated for the first entity in your list and use the current year in the data selection.

3. You can generate a report for any Entity and include the transactions for a specific date range.

Once you are done making changes, click the Update Report button and the report will update.

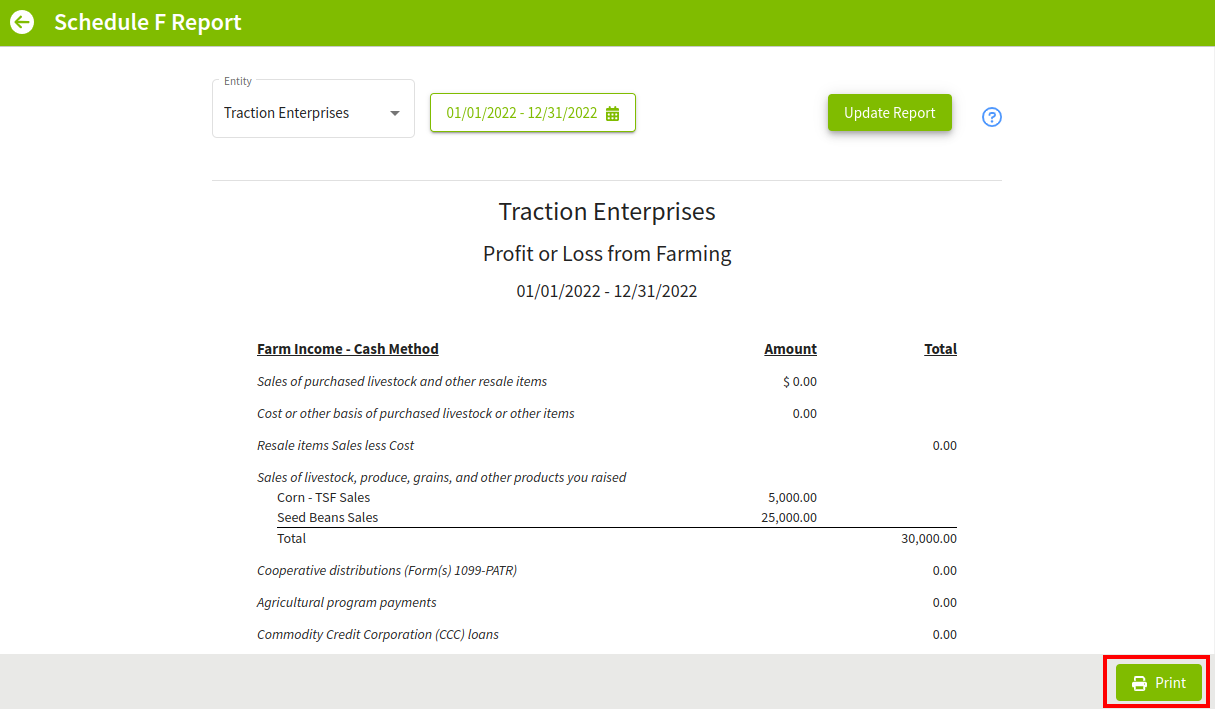

4. Once you have generated a report with the settings you want, you can review the information on the screen or print a copy using the buttons at the bottom right-hand side.