In this article we'll walk through the account creation and linking process for your remaining payroll accounts.

This article only applies to the Traction Payroll product.

|

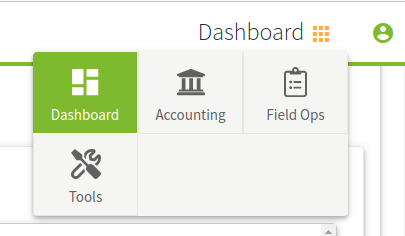

1. Navigate to the Dashboard |

|

|

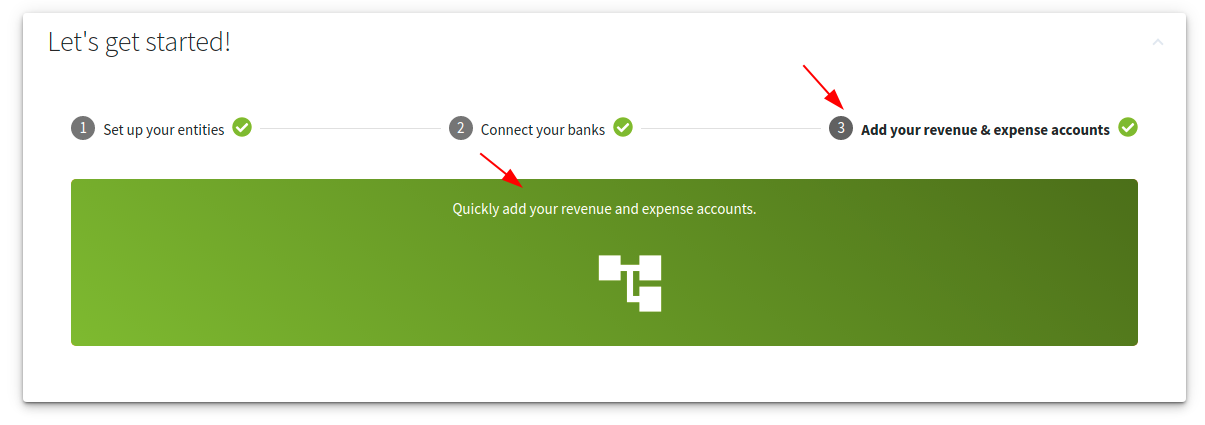

2. Click on Let's get started... to display your options Click on #3 Add Revenue and Expense Accounts Click the green button to enter the Chart of Account wizard |

|

|

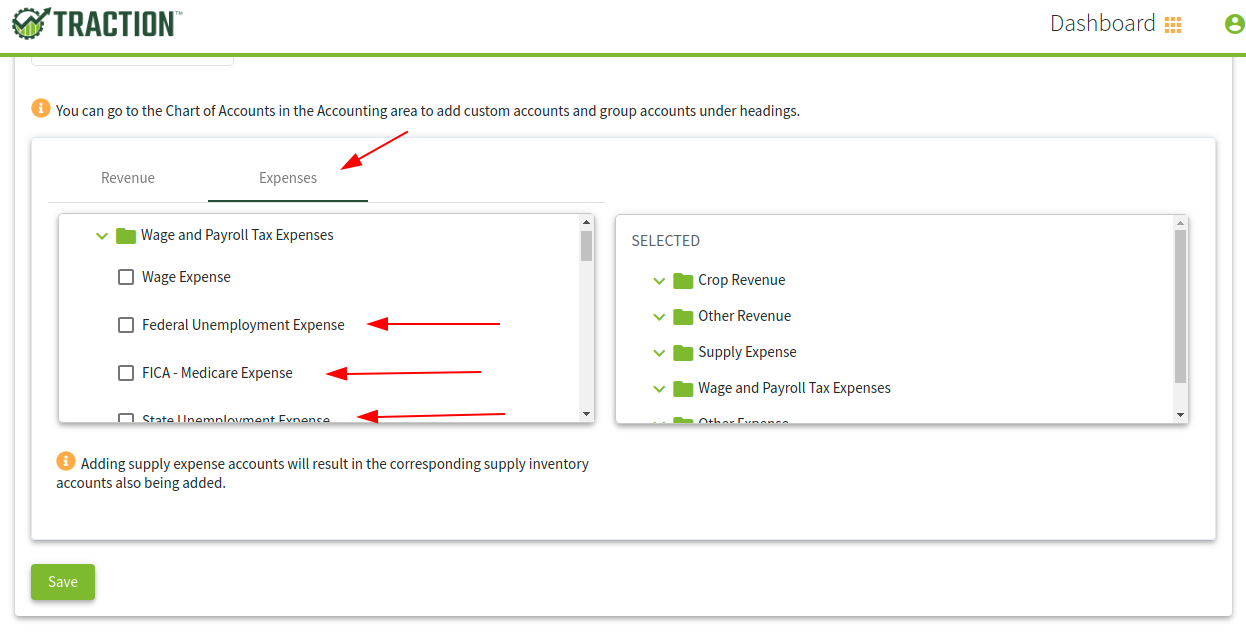

3. Select the entity you use for Payroll Select the Expenses tab Scroll to Wage and Payroll Tax Expenses and select the appropriate ones to add Most businesses will want to include all four accounts. Once you have selected the new accounts, click the Save button |

|

|

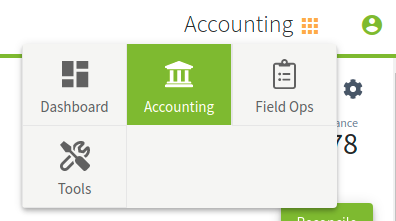

4. Navigate to Accounting |

|

|

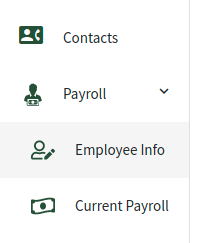

5. Navigate to Payroll->Employee Info |

|

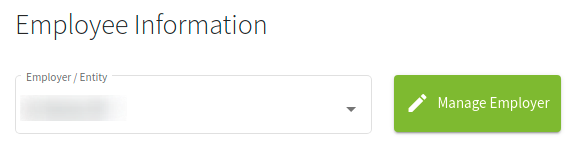

| 6. Click on Manage Employer |  |

|

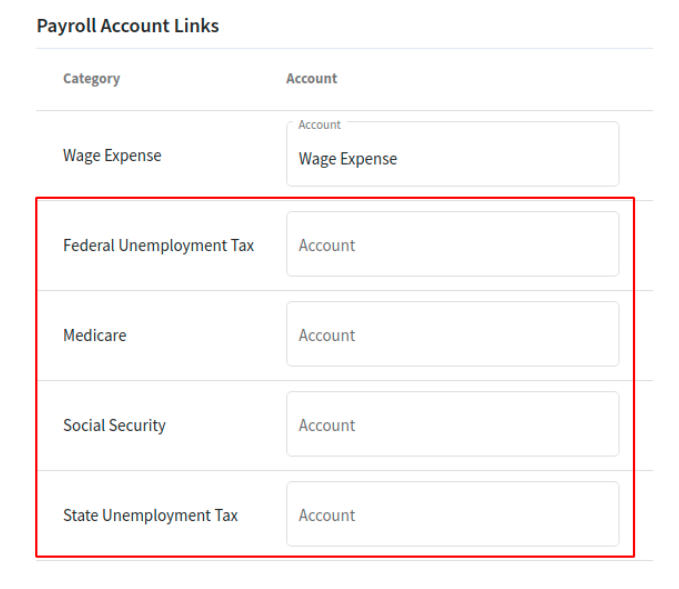

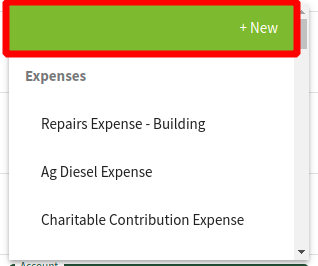

7. In the Manage Employer screen, you will see the additional deduction accounts that you will need to link. Select the appropriate accounts for each of the categories. If you used the above steps to create these accounts, you would map them as follows: Wage Expense - Wage Expense Federal Unemployment Tax - Federal Unemployment Expense Medicare - FICA - Medicare Expense Social Security - FICA - Medicare Expense State Unemployment Tax - State Unemployment Expense If you have additional deduction expense accounts that need to be created, you can do so by clicking on the +New button when selecting an account. Follow the onscreen prompts to create your additional account(s) |

|

| 8. After you have updated your account links, click the Save & Close button to return to the Employee Info page |  |

You will now be able to run another payroll through Traction.