How do I set up a Land Agreement when two operating Entities split a Crop Share?

Overview:

Land Agreements can be complex, especially when you operate with more than one Entity. This article provides examples of how you can setup Land Agreements when more than one Entity receives the Lessee portion of the Crop Share.

Requirements:

- Farm Entities and Landowners setup on the Setup>Entities page.

Process:

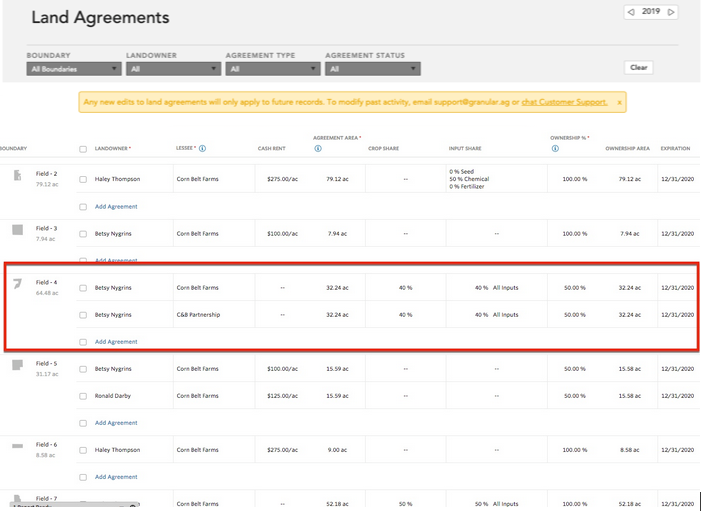

In the first example, we have three entities: one Landowner and two Lessees. Landowner Betsy receives 40% of the crop and pays for 40% of inputs. The two Lessees (management entities C&B Partnership and Corn Belt Farms) split the remaining 60% of the crop and inputs.

- On Setup>Land Agreements, navigate to the field you are editing and click Add Agreement.

Because we have more than one Lessee, we must add more than one agreement. Follow these steps to add an agreement.

- Specify the Landowner.

- Choose the Lessee.

- Enter Cash Rent, if applicable.

- Specify the Agreement Area.

- Enter Crop and Input Share percentages.

The percent value you enter is the percentage that goes to the Landowner. The Lessee receives the remainder.

- Adjust the Ownership Area.

- Click Add Agreement to enter the second Lessee.

In this example, make each agreement the same because the Lessees are splitting the remaining 60% crop and input share equally.

- Set the Ownership Area to 50% for each Land Agreement (this means we are only looking at half the field for each agreement)>

- For both the crop and the input share, attribute the full 40% to the Landowner on each Lessee's agreement.

(40% of 50%) + (40% of 50%) = 40% of the full 100% of the field.

For the Lessees, each lessee gets full 60% of the remainder, but only on half the field; therefore each gets 30% of the field total.

To summarize: with this setup, the Landowner is receiving 40% of the total crop and paying for 40% of all inputs. Each Lessee is receiving 30% of the crop and paying for 30% of the total inputs.

Let's look at the crop share:

If the 32 acre field yielded 5,800 bushels:

- Our landowner (Betsy Nygrins) receives 40% of that yield.

- Our two management entities (Corn Belt Farms and C&B Partnership) split the remaining 60%

If we look at the calculation for the Landlord as per the Land Agreements, we assigned:

Agreement 1 (.40 x (.5 x 5,800) + Agreement 2 (.40 x (.5 x 5,800)

= 2,320 bu owned by Betsey Nygrins (or 40% of 5,800 bu)

Let's look at the input share:

If the 32 acre field required the use of 1,000 gal of AMS:

- Our landowner (Betsy Nygrins) pays for 40% of that AMS

- Our two management entities (Corn Belt Farms and C&B Partnership) split the remaining 60%

If we look at the calculation for the Landlord as per the Land Agreements we've assigned:

Agreement 1 (.40 x (.5 x 1,000) + Agreement 2 (.40 x (.5 x 1,000)

400 gal of AMS attributed to Betsey Nygrins (or 40% of 1,000 gal)

Related Articles:

How do I setup Land Agreements for a field with multiple Landowners?

What happens if I assign or change a Land Agreement after I begin to harvest that Fie