How do I set up a flex or bonus lease?

Overview:

Understanding that leases come in a variety of formats, including Flex and Bonus leases, Traction Enterprise can help you manage even these more complicated agreements.

Process:

The best way to track Flex or Bonus leases in Traction Enterprise Business is to estimate your rent per acre for the field where you have the lease.

- Go to Setup>Land Agreements.

- Assign Cash Rent to the Landowner using your estimated total rent per acre as the rate per acre.

- After harvest is complete, calculate the actual rental amount, go back into your Land Agreement, and adjust the rate per acre to the actual amount you paid.

Example

Here's an example of estimating and recording a bonus lease in Traction Enterprise:

The Bonus Lease is set up with a base rent of $150 per acre and 35% gross revenue share of anything over $403 ($150 in land cost + $253 estimated cost of production).

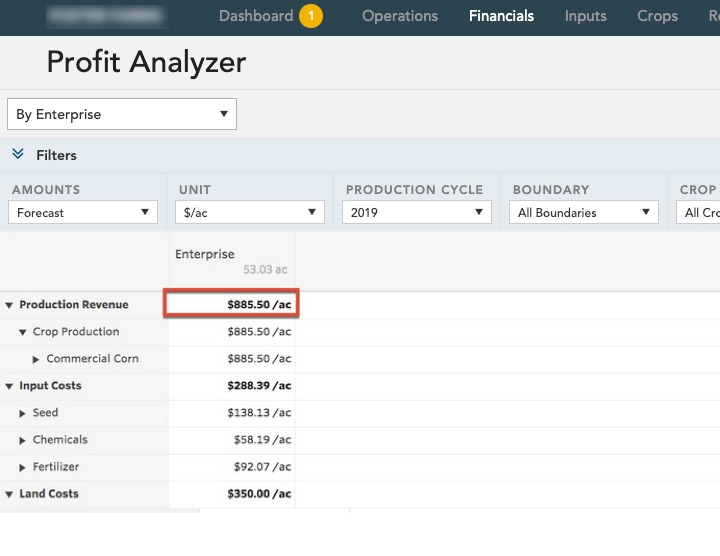

To estimate the total rent per acre for this lease, you look at the Profit Analyzer page for the field where the Bonus Agreement is set up and determine what the estimated revenue is based on what you input as a projected price and yield for this field.

In the example below, the estimated revenue is $884.50 per acre; therefore, the 35% revenue share is based on $481.50 ($884.50 in revenue - $403 in production costs). This means the estimated Bonus Payment is $168.53 ($481.50 x 35%) and the estimated rent per acre for this field is $318.53 ($150 base + $168.53 bonus).

Related Articles:

Getting Started: How to add Land Agreements

How do I copy Land Agreements from year to year?